When making trades on the foreign exchange market, knowing what exotic currency pairs are and how they different from major currency pairs is important.

Exotic currency pairs put together a major currency from a developed country with a currency from a developing country. For example, pairing a Hungarian forint (HUF) and the USD would be an exotic currency pair.

What is an exotic currency pair?

Exotic currency pairs are currencies that are not as widely traded in forex exchange markets. These exotic currencies are not liquid, have high volatility, and trade in the market at smaller volumes.

Most exotic currencies are found in developing countries whereas they may not be able to be converted on a forex exchange because of exchange rate controls. It can become very expensive to trade an exotic currency because the bid-ask spread is high to accommodate for its illiquidity.

Examples of exotic currencies include the Iraqi dinar, Thai baht, and the Uruguay peso, which originate from countries that do not have a strong economy or well-rounded trading network.

Click here – Useful Tips for Teaching Elementary School Students in an Online Classroom

Examples of exotic currency pairs include:

- AUD/PLN (Australian Dollar/Polish Zloty)

- CAD/SGD (Canadian Dollar/Singapore Dollar)

- EUR/HUF (Euro/Hungarian Forint)

- EUR/CZK (Euro/Czech Republic Koruna)

- EUR/PLN (Euro/Polish Zloty)

The different strategies for trading exotic currency pairs

There are four strategies for trading exotic currency pairs including day trading, position trading, scalping trading, and swing trading.

Day trading has more chance of a loss happening because it’s done quicker than other trading options and there’s lower commissions involved.

Scalping trading and day trading utilise technical analysis when trading exotic currency pairs. Scalping is done much quicker than day trading because it involves changing positions every so few seconds or even minutes so that these small and quick trades increase a higher possible profit for your market shares.

Swing trading involves trades being held over multiple days or weeks at a time. Those that wish to enter forex trading on a part-time basis should consider swing trading as their main strategy. Utilising a combination of fundamental analysis and technical analysis will help you to get the most of swing trading because prices can change even during these longer time frames.

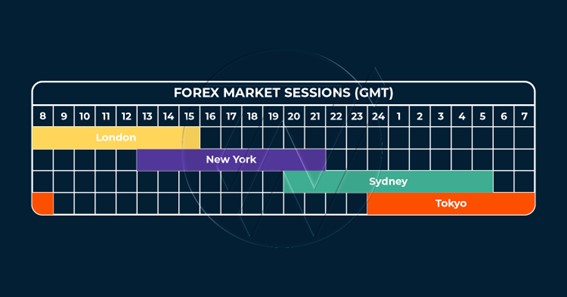

Images created and referenced from Trade Nation – What time does the forex market open. All distribution rights belong to the publisher and cannot be used without written permission.

Exotic currency pairs versus major currency pairs

Since exotic currency pairs are considered illiquid with a higher volatility and a lower percentage of daily trading on foreign exchanges, major currency pairs are the total opposite. These currencies are very liquid because of their stronger economies with a higher percentage of daily trading on the forex exchange and they are not as volatile as exotic currency pairs.

No matter the type of currencies you are trading, use technical analysis to evaluate the performance of exotic currency pairs and major currency pairs. A popular platform for technical charts is TradingView, which is available through brokers such as easyMarkets.

There are 8 major currencies in the forex market, but there are 7 major currency pairs which include:

- AUD/USD (Australian Dollar/United States Dollar)

- EUR/USD (Euro/United States Dollar)

- GBP/USD (Great British Pound/United States Dollar)

- NZD/USD (New Zealand Dollar/United States Dollar)

- USD/CAD (United States Dollar/Canadian Dollar)

- USD/CHF (United States Dollar/Swiss Franc)

- USD/JPY (United States Dollar/Japanese Yen)

Trade your exotic currency pairs using technical analysis

If you are a beginning trader, do not invest in exotic currencies right away due to their higher volatility and risk in investing than major currencies. Start getting used to trading major currencies as a start to diversify your portfolio before you jump into trading exotic currencies.

Click here – What is the physical eligibility required for SSC GD Constable?

To Know Some Great Stuff Do Visit TeluguWiki

To Know Some Great Stuff Do Visit TheHindiGuide

To Know Some Great Stuff Do Visit TheSBB